I went ahead and started a toggle test right way. The idea was to set up a quick methodology for picking your positions. Something systematic so that it can be easily duplicated so I set the following filters:

- Stars – 7 & 8

- Direction – Bullish

- Return – 20% +

- Asset Class – Equities

The logic was pretty straight forward. I’m using this thing because the AI is supposed to tell me what to do. Think of it like going to the doctor. If he tells you you could maybe improve your health by taking some over the counter supplement that hasn’t really been tested, are you going to take it? No! You want him to tell you with certainty. Take this pill. Eat this way. Exercise. It’ll improve your health. Even still you probably won’t listen. Well it’s the same logic here. If I’m going to the AI for advice. It better be pretty darn certain.

I picked bullish because im using Robinhood and the interface kind of sucks for complex investing. Plus Im allergic to leverage. Ironic right, considering im all about #leveragingup. But the weird thing is the philosophy aligns. #LeverageUp is all about maximizing efficiency, which by definition hedges against catastrophic risk. You’re safer if you’re diversified with minimal effort. So if I’m ever short, it’s by owning straight puts. And Robinhood is cumbersome for that. So bullish is fine for me. Besides, if the AI is good. It should work fine in only the upward direction – if we’re in a down market it can just not recommend anything.

An asset class of equities again because I use Robinhood for tests. Also I don’t often invest in other publicly trades assets. And lastly a return of 20%+. Here I would have chosen 10%-20% but why settle if the AI gave some good choices in the higher range.

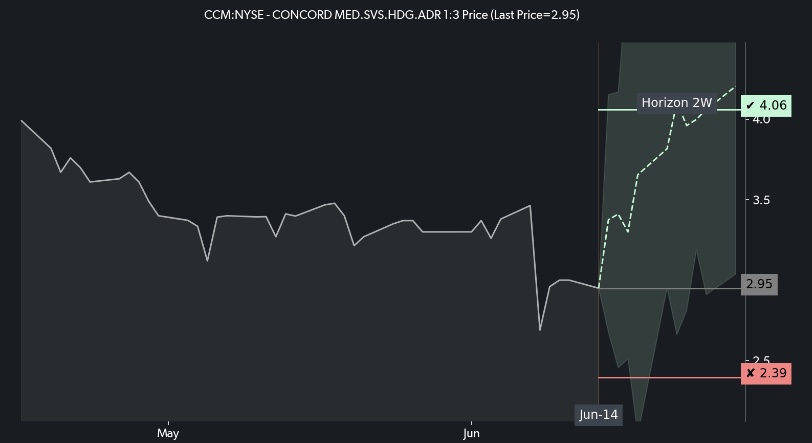

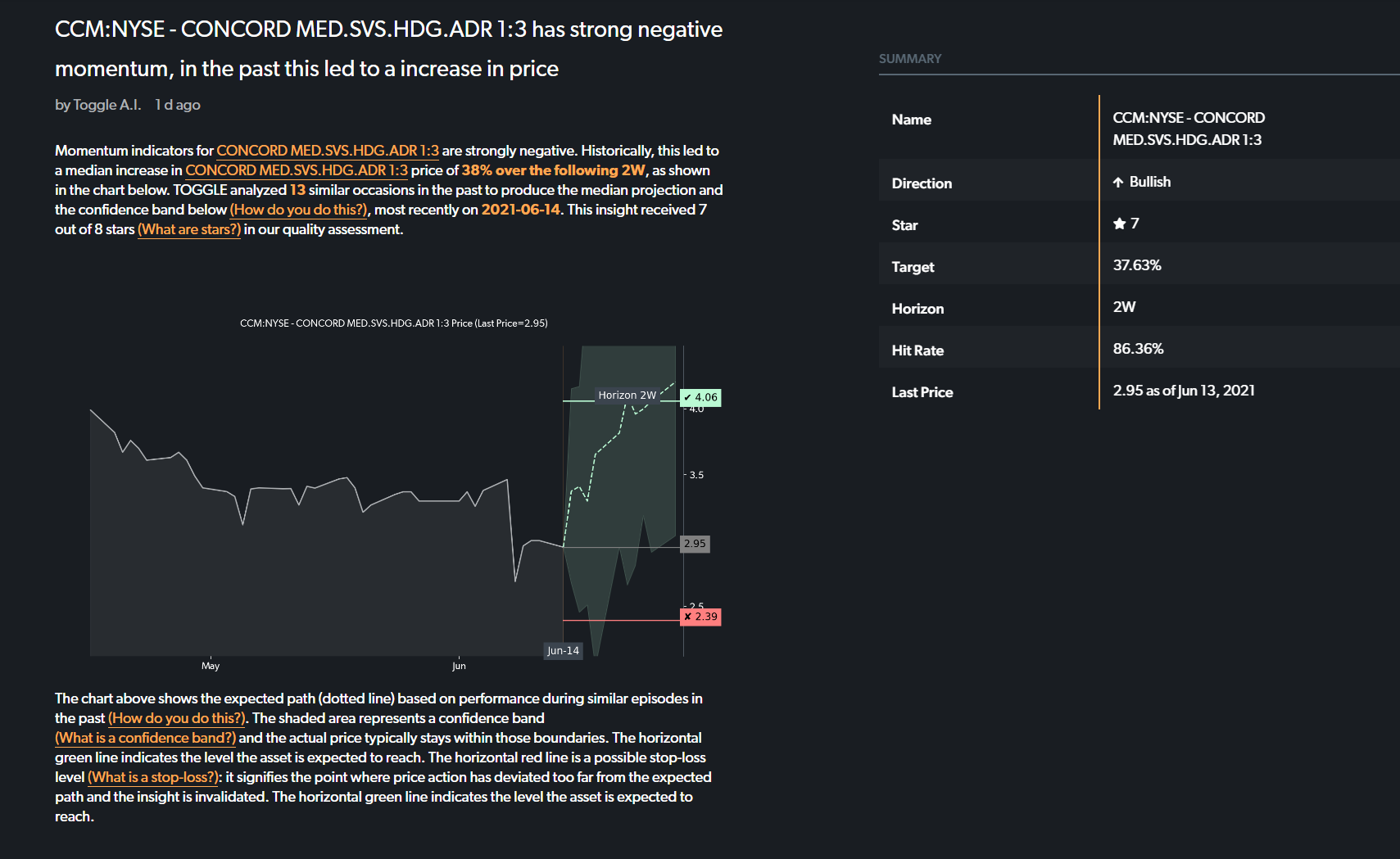

I then went ahead and chose a few tickers. I did one last check – I looked at the hit rate. Everything was 85%+ which seemed reasonable. I don’t know what my lower limit is. In fact I don’t know exactly what the hit rate is. I imagine it tests the recommendation again at historical events and provides the accuracy of the prediction in the back-test? Anyway the point of this is to have minimal upfront effort. Since this isn’t exactly #leveragingup anything in particular – it’s actually ignoring my existing knowledge of equities. But it’s fun nonetheless. So let’s see how I do. Ahem, I mean how toggle does…